The #government recently protected all deposits of Silicon Valley Bank and #Signature Bank after they failed

TipMeACoffeebeta

Tassat has a pipeline of six banks, which include the recently-shuttered #Signature #Bank.

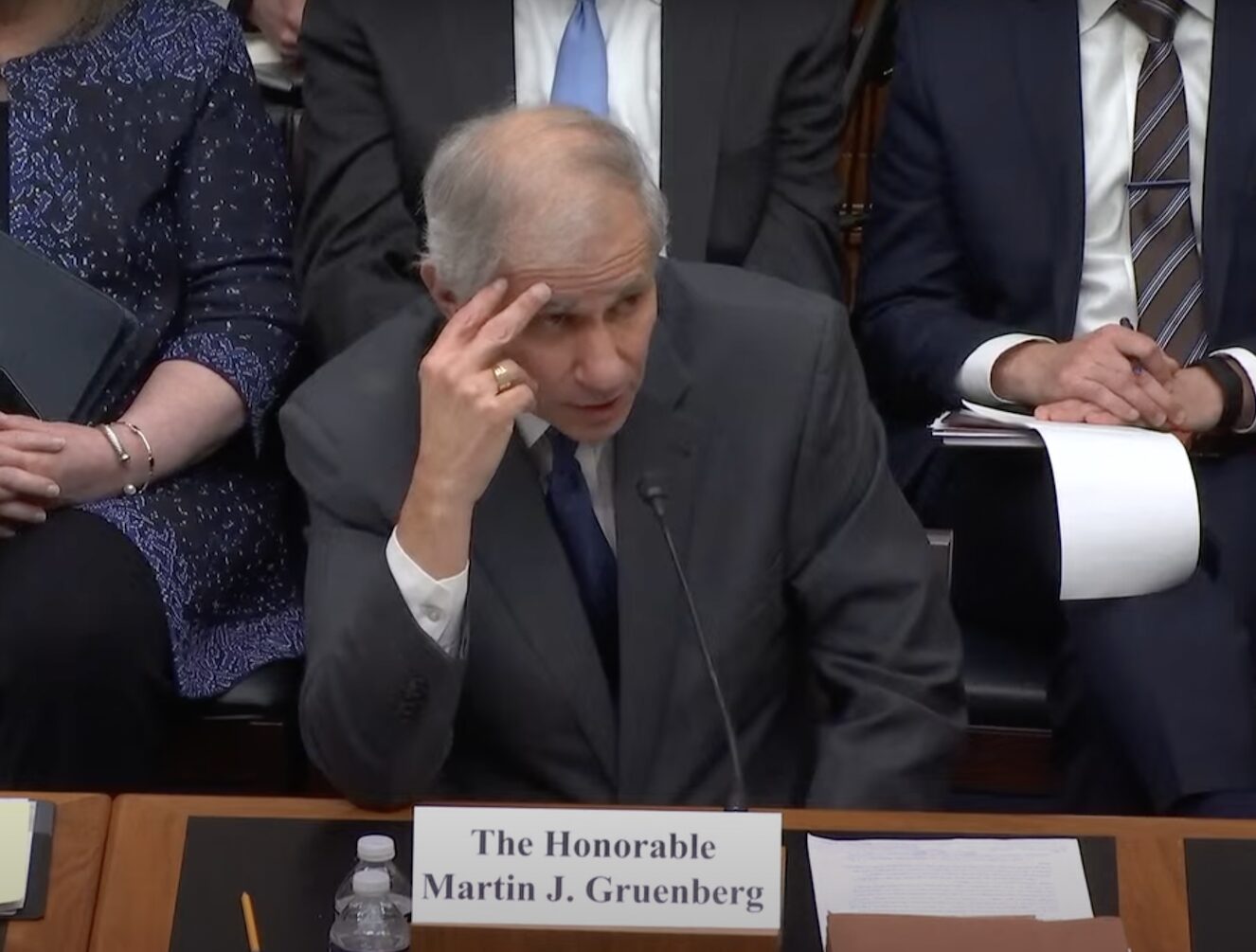

“I know that #Signature had activities involved in digital assets, but I don’t believe that is the #main [cause].”

The U.S. #banking industry fell into turmoil this month, with Silvergate Bank, #Signature Bank and Silicon Valley Bank all collapsing in the same week

#Signature Bank was seized by the New York State Department of Financial #Services last Sunday, becoming the third-largest bank in the U.S. to fail.

The lawmaker argued that #Signature Bank supported efforts to curtail capital #requirements stipulated in the Dodd-Frank Wall Street reform law, the publication conveyed

“Despite #assurances made to Congress that mid-sized banks like #Signature Bank would be able to manage risk independently

#Signature Bank bought into its get-rich-quick narrative … Signature Bank was #caught short because it embraced crypto customers with insufficient safeguards.

#Signature Bank was seized by the New York State Department of Financial #Services last Sunday, becoming the third-largest bank in the U.S. to fail.

The lawmaker argued that #Signature Bank supported efforts to curtail capital #requirements stipulated in the Dodd-Frank Wall Street reform law, the publication conveyed

In contrast, reports suggested #Signature Bank had no issues with solvency at the time of its closure on March 12, but New York #regulators stepped in, giving the FDIC control of the firm’s insurance process.

The U.S. #banking industry fell into turmoil this month, with Silvergate Bank, #Signature Bank and Silicon Valley Bank all collapsing in the same week

Over the course of 2022, #inflation hit significant levels across the globe. In March 2023, #Signature Bank, Silicon Valley Bank and Silvergate Bank all went under.

“Resolution of the negative #balance required a prolonged joint effort among #Signature Bank, regulators,

Deposit outflows from #Signature Bank began March 9 and became acute the #following day, Friday, with about 20% of deposits being withdrawn in hours.

#Signature Bank was more #diversified than Silvergate Bank or SVB

#Signature Bank was seized by the New York State Department of Financial #Services last Sunday, becoming the third-largest bank in the U.S. to fail.

The lawmaker argued that #Signature Bank supported efforts to curtail capital #requirements stipulated in the Dodd-Frank Wall Street reform law, the publication conveyed

“Despite #assurances made to Congress that mid-sized banks like #Signature Bank would be able to manage risk independently

New York-based #Signature was closed by New York regulators on March 12 amid concern that it was #experiencing a bank run and posed a “systemic risk” to the U.S. economy.

Also #excluded from the deal was #Signature’s payments platform Signet, which is powered by blockchain technology to facilitate real-time payments with no transaction fees or limits. The fate of Signet is still currently uncertain.

the deal with the FDIC did not include #approximately $4 billion of deposits related to the former #Signature Bank’s digital banking business.”

While New York #Community Bancorp (NYCB) bought most of the deposits and loans held by #Signature Bank on March 19,

so anyone with funds held with #Signature but unable to transfer them out should at least ensure their #registered address is up-to-date.

In contrast, reports suggested #Signature Bank had no issues with solvency at the time of its closure on March 12, but New York #regulators stepped in, giving the FDIC control of the firm’s insurance process.

The #government recently protected all deposits of Silicon Valley Bank and #Signature Bank after they failed

The lawmaker argued that #Signature Bank supported efforts to curtail capital #requirements stipulated in the Dodd-Frank Wall Street reform law, the publication conveyed

The U.S. #banking industry fell into turmoil this month, with Silvergate Bank, #Signature Bank and Silicon Valley Bank all collapsing in the same week

The #government recently protected all deposits of Silicon Valley Bank and #Signature Bank after they failed

#Signature Bank was seized by the New York State Department of Financial #Services last Sunday, becoming the third-largest bank in the U.S. to fail.

“Despite #assurances made to Congress that mid-sized banks like #Signature Bank would be able to manage risk independently

#Signature Bank bought into its get-rich-quick narrative … Signature Bank was #caught short because it embraced crypto customers with insufficient safeguards.

The lawmaker argued that #Signature Bank supported efforts to curtail capital #requirements stipulated in the Dodd-Frank Wall Street reform law, the publication conveyed

In contrast, reports suggested #Signature Bank had no issues with solvency at the time of its closure on March 12, but New York #regulators stepped in, giving the FDIC control of the firm’s insurance process.

The #government recently protected all deposits of Silicon Valley Bank and #Signature Bank after they failed

Tassat has a pipeline of six banks, which include the recently-shuttered #Signature #Bank.

The U.S. #banking industry fell into turmoil this month, with Silvergate Bank, #Signature Bank and Silicon Valley Bank all collapsing in the same week

The #government recently protected all deposits of Silicon Valley Bank and #Signature Bank after they failed